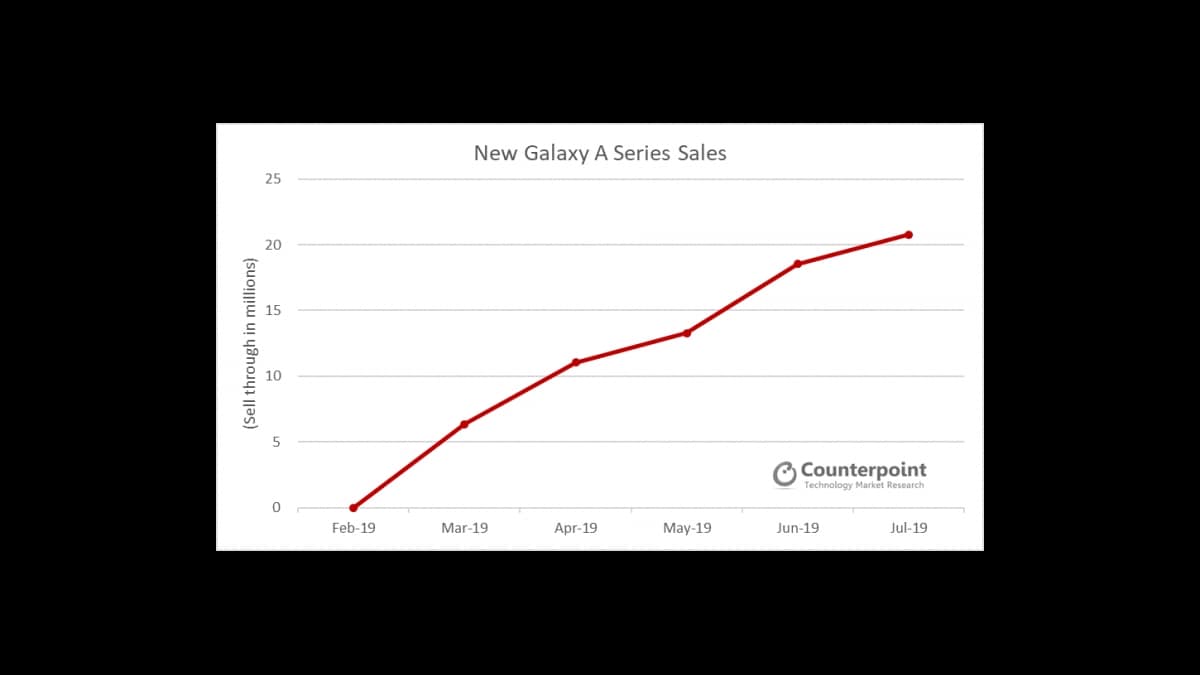

Samsung’s new Galaxy A series accounted for 56 percent of its smartphone sales in the second quarter (Q2) of 2019 and starting with the Galaxy A10 in March 2019, the handset maker has released a new model under the Galaxy A series every month, says a new report.

Till 2019, Samsung had too many smartphone models in the mid-to-low tier price bands and the complicated list of models often left consumers confused.

However, it fixed it in Q1 after it simplified and consolidated its lineup under the new Galaxy A series, said a report by Counterpoint Research.

“This new line of models incorporated the previous Galaxy A series, the Galaxy J series, Galaxy On series and the Galaxy C series. To further distinguish it from the previous Galaxy A series, the new line up used a two-digit number in the nomenclature, for example, the Galaxy A30 and the Galaxy A50,” Sujeong Lim, Researcher, Counterpoint Research, said in a statement.

“But was this lineup rejig successful? The answer is an overwhelming yes given the response that the new A series has received from the market since its launch,” added Lim.

New Samsung Galaxy A series sales

Photo Credit: Counterpoint Research

The global smartphone market price trends over the past year show that the premium tier, above $400 (roughly Rs. 28,300) (wholesale price), is stagnating while the low-end, below $150 (roughly Rs. 10,600), is decreasing.

Growth can be seen in the mid-to-low tier price bands, $150-$300 (roughly Rs. 10,600 to Rs. 21,300). This can be attributed to the trend of new users coming from feature phones to smartphones preferring to trade-up, wherein consumers first use an entry-level smartphone for one-two years and quickly replace it with a smartphone priced between $100-$120 (roughly Rs. 7,100 to Rs. 8,500).

Xiaomi’s rebound and success (in 2017 and 2018) was due to this trend.

Samsung took share from Huawei’s sub brand Honor in the wake of the US trade ban on Huawei, which affected its global smartphone sales.

Regions like Europe were severely affected. Honor products, mainly in the $180-$249 (roughly Rs. 12,800 to Rs. 17,700) price band, accounted for a large portion of sales outside of China, dropped significantly and Samsung’s new A series took advantage and boosted sales volumes.

“It was possible because Samsung had a product portfolio that closely matched the target price range of Honor’s mid-to-low price lineup. In some cases, the value for money proposition was so high that making the switch was quite logical for the practical user,” Lim noted.